Why Personal Finance Now Becoming Famous Day-By-Day In India?

At the point when The lockdown began in 2020, the entire Indian Population sit at their home, for the working class and lower class individuals it's a tuff time for them and they were Losing their employment and they don't have a clue what to do in the present circumstance.

In this way, around then individual budget bring section into individuals' life. They began setting aside cash, putting cash in the financial exchange. At that period in India individuals beginning opening Demat records and begin putting resources into the securities exchange. Presently in india the rate has experienced childhood in the financial exchange. Presently, over 5% of the populace begin putting resources into India after the Lockdown.

This is the reason in the year 2030, half of Indians are putting resources into the financial exchange. Since later on most tycoons become moguls through the financial exchange in India.

Along these lines, If you need to join that tycoon club You need to Start Investing Now-

1) Do what you Passionate About:

You need to do those things which fulfill you not others. In the event that you don't have a decent measure of cash however your companions have don't be envious of them. Continuously have confidence in yourself and stay cheerful.

2)Always pay attention to your work:

Since they need you to be content so consistently pay attention to them and deal with them and take favors from them, then, at that point beginning something stunning that you need to be.

3)Always converse with your companions:

Companions are the one in particular which assists you with developing. Along these lines, consistently share your thoughts and things with your companion that makes you solid.

7 individual accounting tips for novices: Know how to save and spend insightfully in Today's World

Here are some approaches to save and spend intelligently to make each rupee work for your potential benefit.

Better to save up for a rainy day, goes a deep rooted articulation that will hold significance consistently. To develop riches, you need to put a bit of your pay in high yielding speculations. Over the long haul, that is your reserve funds for meeting long haul objectives. Other than contributing, you ought to know about the means to set aside cash in your everyday living and even while going through cash. Each rupee saved and put prudently goes far in building abundance over the long haul.

As an amateur and in any event, for other people, there are three regions that you need to have a solid grasp upon – spending, acquiring and contributing. Afterall, you will spend on fundamentals and utilities, take advances sooner or later of time and contribute to meet life objectives.

Start early:

You need to begin saving as ahead of schedule as conceivable throughout everyday life. In any event, saving a more modest sum won't just development a propensity yet additionally give you a headstart. The force of intensifying will work in support of yourself over the long haul and you could observer an outstanding development in your investment funds. Try not to stall and begin saving right on time as you will require a modest quantity contrasted with a bigger sum on the off chance that you start late.

Save, then, at that point spend:

The overall standard of reserve funds is to spend what stays after you have saved out of your income.If you are spending first and afterward saving what is left, you need to switch the cycle. Thus, pay short reserve funds ought to be the spending.

Check financial balances:

Most of us have more than one ledger. Watch out for the bank proclamations to check whether there are any charges deducted because of various reasons. It's just plain obvious, on the off chance that they can be switched by the bank and make a move to not allow banks to rehash them. Additionally, check for least equilibrium charges and make a move likewise.

Cover hazards:

on the off chance that you have monetary wards, purchase sufficient disaster protection ideally through a term protection plan. Additionally, get wellbeing inclusion for all relatives. By paying a little expense as premium towards these danger covers, you guarantee that your investment funds are not hit when crisis strikes and life objectives are not wrecked for the family.

Visa levy:

If you are in a propensity for turning over your Mastercard contribution every month, you are harming your accounts gravely. The yearly loan fee is near 40% or considerably more in certain cards. Further, in the event that you don't reimburse in full, there is no without interest period on your ensuing buys. Ensure you cover the Mastercard extraordinary sum by the due date to keep away from late expenses and different charges.

Home credit:

If you as of now have a home advance, continue to prepay it and don't hold on to end it according to unique residency. The previous you finish the advance, the more reserve funds will be in interest cost. Likewise, keep a lower residency if the EMI trouble is easily met after family expenses and long-haul reserve funds.

Go advanced:

As far as could really be expected, utilize computerized stages to go out to shop. Be it your home requirements or utility installments or in any event, for purchasing disaster protection. The expense of term protection plans is for the most part lower by right around 25% than the disconnected adaptation of a similar arrangement.

When you develop a propensity for saving money on little exchanges and on day-by-day tallies, the outcome will be apparent over the long run and you will discover fresher approaches to continue saving all the more even while spending. The two things can go connected at the hip for saving a sizable sum over the long haul.

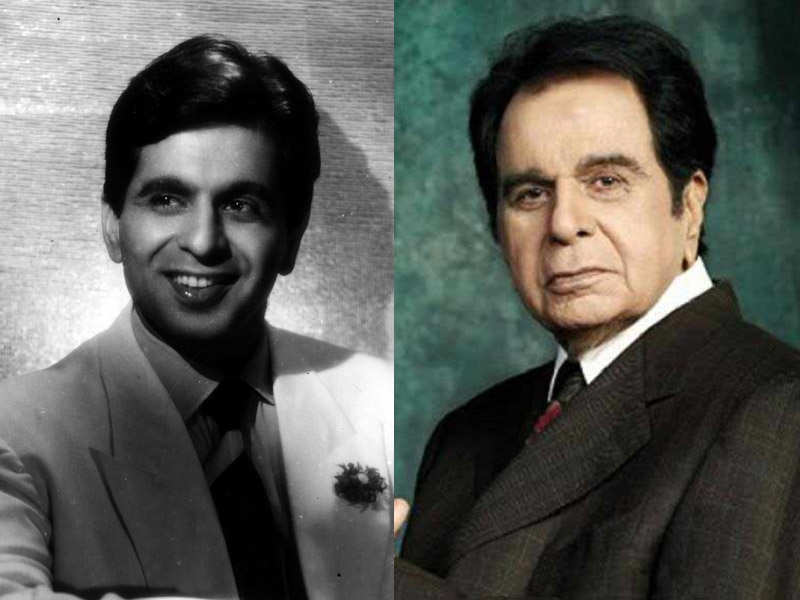

5 money lessons from Dilip Kumar: Personal finance ideas learnt from Tragedy King

Today, we pay tribute to Dilip Sahab and look a little deeper to derive crucial financial and investing lessons that we can adopt from his life, death, and body of work. Or, as Prince Saleem would say, “ Investments jo timely, regular aur disciplined Nahi Hoti, vo long-term wealth creation Nahi, ayaashi hai, gunaah hai”.

Dilip Kumar, without a doubt, was a man of countless seasons. From ushering Naya Daur to pioneering Kranti, the tragedy king of India had seen India transform. But he remained, towering as ever over the years, entertaining us as Prince Saleem, Devdas, Ram Aur Shyam, and more in his stellar career spanning six decades. Indian cinema has changed today, for sure, with the death of cinema legend Dilip Kumar aka Yusuf Sahab, who passed away today due to age-related ailments, at the age of 98.

Strike a balance between Ram and Shyam

Arguably one of his most memorable films, in a departure from his usual tragic roles, Dilip Sahab essayed the dual characters of Ram and Shyam, twin brothers lost in a childhood fair who grow up as completely different individuals. While Ram is meek, timid, and is not a risk-taker by nature, Shyam is flamboyant, outspoken, brash, and aggressive. And together, they make for a great duo.

Similarly, your portfolio deserves a balance of both high-risk-high return equity instruments, cushioned by the safety and stability of your debt investments. In the face of market volatility, while equity will ensure solid and competitive gains on the back of growing companies, your debt funds will make sure you do not lose significant money by investing it in safe, government-backed securities.

Do not even let the king sway you, because investment kiya to Darna kya?

The rebellious Prince Saleem went against his father, the great king Akbar, to profess his love for Anarkali, who was a mere court-dancer. While the infuriated king did everything possible to separate the two, Salim and Anarkali still went down in history as classic examples of love and endurance.

Market ups and downs can be scary, forcing you to reconsider your investment decisions. Seeing the Nifty and Sensex in red can discourage you to not put money in the market, or withdraw it after every downtrend. Do not. Wealth-creation is a long-term, gradual process that takes time, so do not let small market setbacks scare you. The stock market is bound to revive in the long run, and then, thanks to the power of compounding, which is simply the accumulation of interest over interest, you will be sitting on a comfortable corpus. In fact, the BSE Sensex has appreciated more than 9,000% since its inception and the NSE Nifty has grown by more than 1,000% since its start in 1992. Persistence pays off!

Kaun invest karta hai market chodne ke liye? Hum to invest Karte hai taaki future secure kar sake

The Bimal Roy directorial remains one of Dilip Kumar’s cult classics. His severe alcoholic mannerisms eventually lead to his death, but there is something else to learn here as well.

Trading, as many people see it, offers a shortcut to make quick bucks and profits, without having to devote much time and energy as demanded by investing. That’s incorrect. Indeed, trading is exciting and thrilling, much like the rush of alcohol. But jumping into trading deep waters without having enough knowledge, sufficient prior investments, and high leverage are dangerous, akin to gambling. Set aside a comfortable amount of investments that guarantee your financial security, and then start trading in the market with caution and understanding.

Embrace the Naya Daur

The fight between a bus and a tonga might seem weird, more so when we see Shankar’s tonga emerging as the winner. But the movie does have an important lesson to teach, to be more embracive and accepting of new, potentially successful small-cap and mid-cap companies. Though they are rife with risks, they are the future. Instead of banking only on bluechip and large-cap funds, you must allow at least 5-10 percent of your portfolio to such stocks. The S&P BSE Smallcap index (112.82 percent) has also managed to outperform Sensex (93.49 percent) over the last five years, so there's some encouragement there!

Do not be afraid to kill your kin

Do not worry, it's not as violent as it sounds. In Shakti, starring alongside Amitabh Bachchan in one of his last films, Kumar played a virtuous police officer who was willing to let his own son die in exchange for not letting a gangster loose and breaking the law.

Similarly, our assessments about the market can go wrong. Do not hesitate to own up to your investing mistakes and in making prompt portfolio corrections as and when there is a need. With regular assessments and periodic check-ins with your investment plans, you can make sure you are on the right track to financial safety!

Why personal finance is crucial in everyday life

Possessing adequate personal finance management skills can help us manage our money well, and ensures a bright financial future.

For financial freedom, personal finance has a significant role to play. It’s essential that we plan for and manage money at every step of our lives. Without proper planning, we would be living a life of bondage, not knowing how to get off debts and credit as well as sufficiently pay our bills. Living paycheck to paycheck is a highly stressful way of living. While we may have a job that pays for our daily expenses, long medical bills or any other emergency could wreak havoc on us financially. Hence, possessing adequate personal finance management skills can help us manage our money well. it further ensures a bright financial future.

Financial literacy is just like learning any other language. One needs to utilise and apply their knowledge to be proficient. Certain terms and concepts need to be on our tips and like any other task, even in this case, practice helps build awareness of money matters. Irrespective of our age, profession or income level, a robust understanding of one’s financial situation helps one be responsible with how they use and allocate the money that they earn.

Basic Tenets of Personal Finance

Personal finance primarily refers to the financial management of a person’s or a family’s resources. It comprises ways of managing money through investments, expenditure and savings, taking into consideration various life risks and events. Other facets of personal finance include budgeting, banking, planning for retirement, insurance, and more. The term also stands for the various financial institutions which offer financial services to a person during their lifetime.

Personal finance majorly focuses on fulfilling an individual’s long-and-short-term financial goals. Everything from having enough money for important monthly bills to planning one’s retirement constitutes personal finance.

Why Personal Finance is Essential

Those who begin savings at an early age accumulate enough money to play with later in life and easily get through the rainy days. Saving even a little amount a day can help add up enough over the years and those who regularly save reap the rewards.

Here are some reasons why financial management is necessary:

1. Helps Meet Money & Security Needs

Money issues go much beyond what we usually think about. We need to have a broader perspective of our finances as this way, we will think more than just going to work and earning money. One shouldn’t simply spend right after making money. Rather we should have a plan in place for establishing how much our income is, what our expenses are, and our future financial goals. This way we will build financial security for ourselves and fulfill our needs accordingly.

2. Helps in Budgeting, Saving & Spending

Even after earning a hefty sum every month, we could be living in huge debts if there is no financial plan in place to utilise that income judiciously. This is because we might end up spending more than we earn, sometimes even without realising it. However, someone who might be earning a mediocre income may be living a more financially sound life. This is because they plan for their money, save and live within their means. Personal finance helps us make sense of our earnings, monthly expenses and how to budget within that income.

3. Helps Increase Cash Flow

Personal finance can help us increase our cash flow. Keeping a track of our expenditures and spending patterns enables us to increase our cash flow. Tax planning, spending prudently, and careful budgeting ensure that we do not lose our hard-earned money on frivolous expenses.

4. Keeps Off Unmanageable Debts

Being overly in debt poses a serious danger to our future finances. Knowing personal finance teaches us how to manage our debts. Avoiding overspending can help us stay off debts. For instance, some people tend to change their lifestyle upon earning a higher income. This only leads to falling into more debts. Overuse of credit card can also add to our debts. This is why personal finance is essential.

5. Helps Grow Our Assets

Many people want to own assets, rather than ask for it from others, as a form of financial cushion. But several assets come with some liabilities attached. This necessitates possessing an adequate knowledge of our finances. By understanding our finances, we can determine the real value of a particular asset as well as know how to settle or cancel liabilities. This way we can effectively grow our assets.

Conclusion

One step towards having a stable financial future is to build a deep knowledge of our finances. It’s important that one makes a change in their spending habits and plans their budget and income before they fall too deep in a financial crisis. Every person must devote time to improving their financial knowledge so as to have a secure future.

How to become a crorepati by investing in a small savings scheme?

Small saving schemes, which offer a higher interest rate than bank fixed deposits, can make investors crorepati over the long run as they have an upper limit on the maximum investment, experts say.

Is it still worth investing in mutual funds?

Why India's mutual fund's boom is restricted to large cities?

More than 80 percent of the MF industry's assets come from large urban centers. In small cities and towns, the interest in mutual funds is less. Real estate, gold, bank deposits, and insurance products are still preferred in the hinterland.

Mutual fund (MF) reach in India is among the lowest in developing countries and much below the global average.

A recent Jefferies report states that assets under management held by the MF industry is just 12 percent of India’s GDP, whereas the global average is 63 percent. Other developing nations such as Brazil (68 percent of GDP) and South Africa (48 percent of GDP) have much higher proportions of mutual fund investors. So, where is the Indian household deploying its savings?

Bank deposits, insurance funds, and provident & pension funds accounted for two-thirds of the financial assets of Indian households as of December 31, 2020, according to data released by the Reserve Bank of India (RBI).

Mutual fund investments formed just 9.4 percent of an Indian household’s savings in financial assets.

8 Personal Finance Changes From July

1. IFSC code of Syndicate bank

- IFSC code, as well as cheque book of Syndicate Bank, will become invalid from July 1.Likewise, the customers of Syndicate Bank have been asked to update IFSC code latest by June 30."Dear customer, replace e-syndicate cheque book and cheques issued to the third party as validity for presentation expires on 30.06.2021," Canara Bank said.

- Post office small savings scheme may see a rate cut following the low interest rate regime. Amid the state assembly elections last quarter, the centre after reducing rates on small savings scheme rolled back the rate cut. Rate on small savings schemes are linked to yield on 10-yeargovernment securities and are revised quarter on quarter.

3. TDS rules to change from July:

- There will be a verification of taxpayers done and those taxpayers who would not have filed ITR for the last two years shall be charged a higher TDS. The rule is for taxpayers for whom the TDS deduction value exceeds the threshold value of Rs. 50000. The rule is part of the new insertion made to the Finance Act, 2021.

4. SBI cash withdrawal and cheque leaflet changes:

- The country's leading lender has announced that with effect from July 1, 2021, the bank's customers will be allowed just 4 withdrawals from the bank ATM and branch. Beyond the free transaction, the lender shall charge Rs. 15 plus GST on each the transactions. Also, in respect of the checkbooks, there shall be a limit imposed i.e. customers can now make use of as many as 10 cheque leaflets and beyond those, they will be levied some charges. For cheque leaflets beyond 10, there will be levied Rs. 40 plus GST, while for 25 leaves there will becharged Rs. 75 plus GST. But no such charges have been announced for senior citizens.

- LPG or cooking gas cylinder prices are also revised month on month and it is likely that there can be a revision in Lpg cylinder price. The LPG is sourced and extracted from natural gas and crude.

- In order to offset rising input costs, auto companies from Hero Motocorp to Maruti shall increase vehicle prices from July this year.

- Corporation Bank and Andhra Bank has been merged with Union Bank and likewise

the customers of the two banks have been asked to get a new cheque book with

latest security features.

8. IDBI Bank charges revision for locker

- , savings account, cheque leaflets: Beyond 20 leaflets, the bank will have to pay Rs. 5 per cheque after the free limit. But this is not levied if you maintain a IDBI 'Sabka Saving Account'

No comments:

Post a Comment